Who is Casual Taxable Person (CTP) in GST?

Introduction to Casual Taxable Person in GST

In the realm of Goods and Services Tax (GST), a Casual Taxable Person refers to an individual who occasionally undertakes transactions involving the supply of goods or services, but does not have a fixed place of business. This provision caters to those who engage in business activities in a sporadic manner, such as during festivals, exhibitions, or trade fairs, where they may not have a permanent establishment.

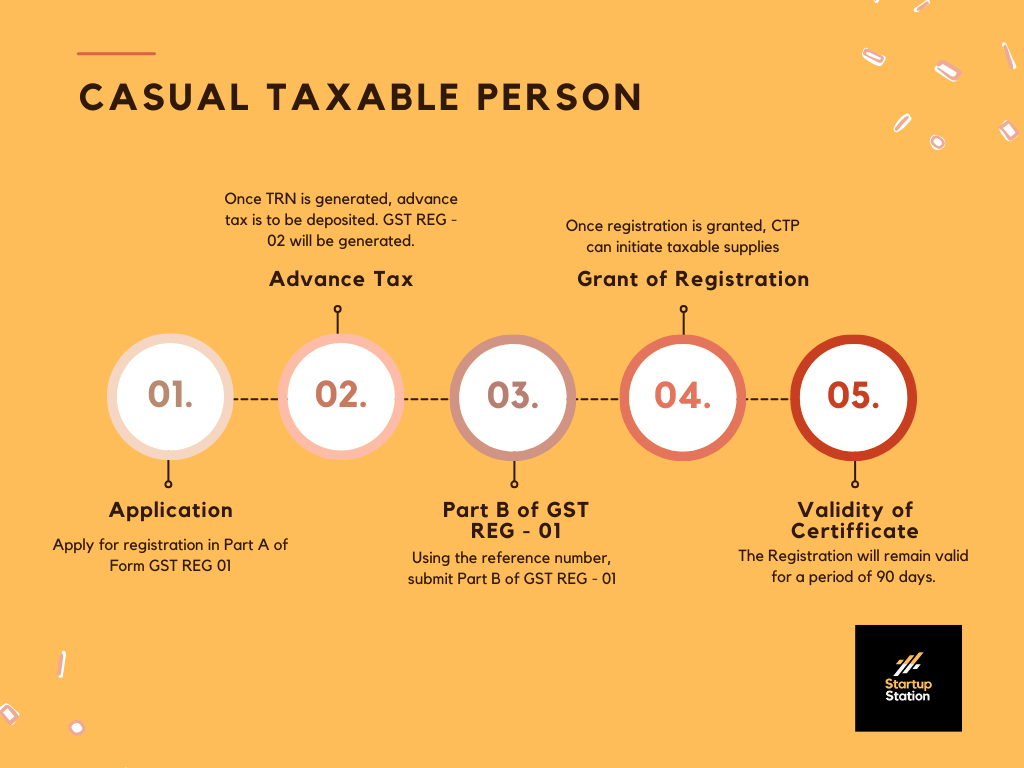

Registration of Casual Taxable Person

When it comes to GST registration, the rules vary depending on the nature of the supplier and their turnover. While most suppliers need to register if their turnover crosses the 20 lakh rupees threshold, there are exceptions. Certain suppliers, such as Casual Taxable Persons (CTPs), are obligated to register regardless of their turnover.

Unlike regular suppliers, the 20 lakh rupees turnover limit doesn't apply to CTPs. Instead, they must acquire temporary registration, valid for a maximum of 90 days in the state where they intend to supply as a casual taxable person. Additionally, CTPs are ineligible for the Composition Scheme.

To illustrate, let's consider Mr. Rajeev, who estimates his taxable services at Rs. 500,000. In order to obtain temporary registration, he must make an advance deposit of Rs. 90,000 (18% of Rs. 500,000), based on an estimation of his tax liability.

Extending Registration as Casual Taxable Person (CTP)

To extend the validity of registration as a Casual Taxable Person (CTP), one must submit FORM GST REG-11 before the current registration expires. This extension can be granted for up to an additional 90 days, subject to the deposit of additional tax liability for the extended period.

Important GST Return deadlines for a Casual Taxable Person (CTP)

Regarding returns, a CTP must adhere to specific deadlines:

FORM GSTR-1, detailing outward supplies of goods or services, is due by the 11th of the following month.

FORM GSTR-3B, summarizing Input Tax Credit (ITC), purchases, and tax liability, must be filed by the 20th of the subsequent month.

However, if a CTP opts for the Quarterly Return Monthly Payment (QRMP) scheme, they will file IFF/GSTR-1 and GSTR-3B on a quarterly basis.

Unlike regularly registered taxpayers, a CTP is not obligated to file an annual return.

Refunds for Casual Taxable Person

Refunds for CTPs are processed once all necessary returns for the registration period have been submitted. To claim a refund of excess deposited amounts over the tax liability, one must fill out Form GST RFD-01 under the category "Refund of excess balance in the electronic cash ledger." These forms can be submitted via the common portal directly or through a Facilitation Centre authorized by the Commissioner.

FAQs relating to Casual Taxable Person

-

Can a casual taxable person claim input tax credit?

Yes, a casual taxable person can claim input tax credit on eligible inputs used for making taxable supplies.

-

What is the validity period of registration for a casual taxable person?

The registration as a casual taxable person is valid for a specified period, typically 90 days, which can be extended if necessary.

-

Is there a threshold limit for registration as a casual taxable person?

No, there is no threshold limit for registration as a casual taxable person. Any individual meeting the eligibility criteria can register.

-

Can a casual taxable person voluntarily cancel their registration?

Yes, a casual taxable person can apply for voluntary cancellation of registration if they no longer intend to carry out business activities.

-

Are there any penalties for non-compliance by casual taxable persons?

Yes, failure to comply with GST regulations by casual taxable persons can attract penalties as per the provisions of the GST law.