Which Business Entity is the Right Choice for You in India?

Introduction

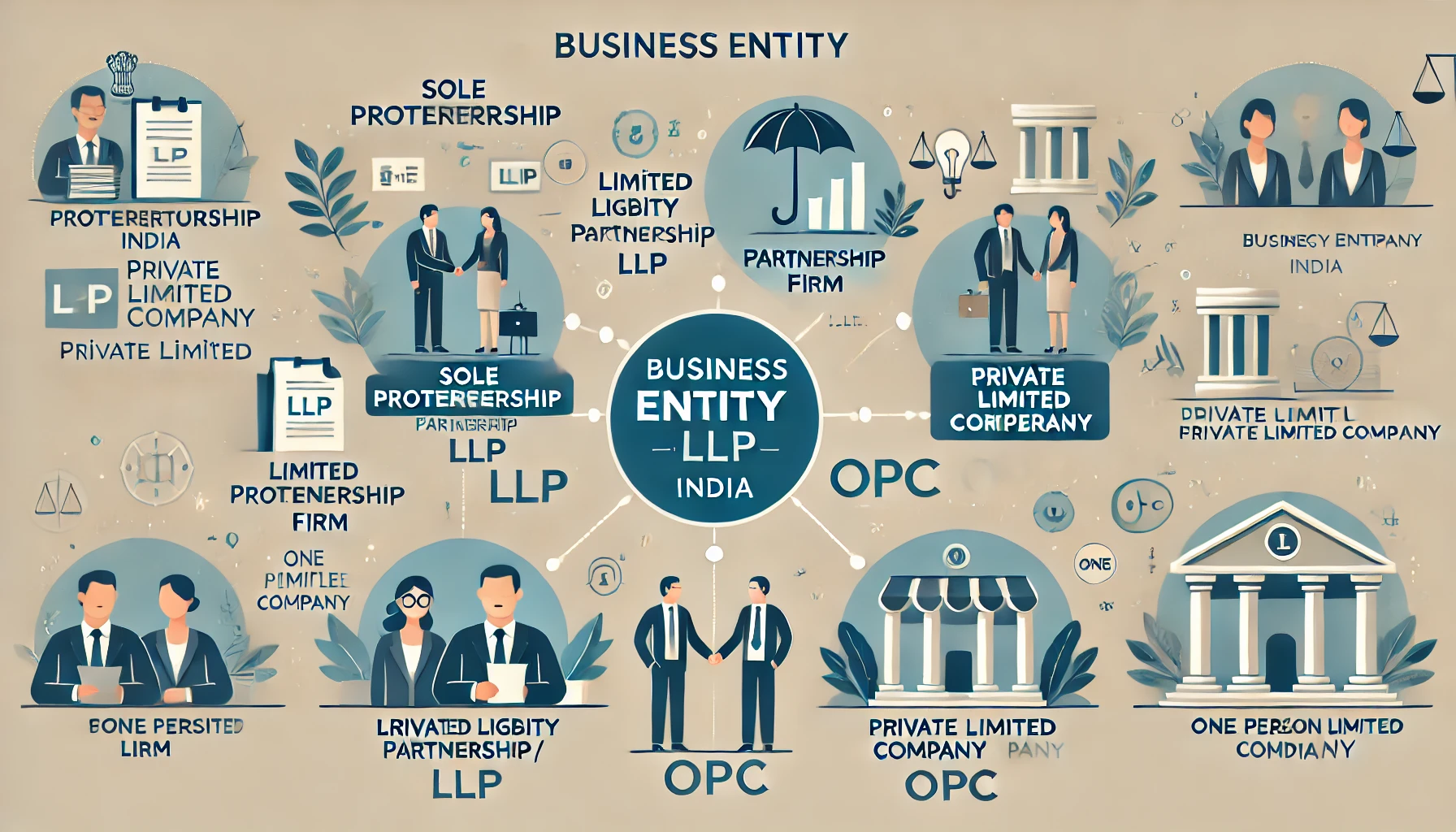

Choosing the right business entity is a crucial step in setting up a new business in India. The structure you select can affect your taxes, your liability, and your ability to raise capital. This guide will help you understand the various types of business entities in India and determine which one might be the best fit for your business.

Table of Contents

- Understanding Business Entities in India

- Sole Proprietorship

- Pros and Cons

- Who Should Choose This?

- Partnership Firm

- General Partnership

- Limited Liability Partnership (LLP)

- Pros and Cons

- Who Should Choose This?

- Private Limited Company

- Benefits of a Private Limited Company

- Drawbacks of a Private Limited Company

- Who Should Choose This?

- Public Limited Company

- Benefits and Drawbacks

- Who Should Choose This?

- One Person Company (OPC)

- Benefits and Drawbacks

- Who Should Choose This?

- Comparing Business Entities

- Factors to Consider When Choosing a Business Entity in India

- Tax Implications in India

- Liability Considerations in India

- Ease of Formation and Management

- Flexibility and Scalability

- Raising Capital

- Examples and Case Studies

- Frequently Asked Questions (FAQs)

- Conclusion

Understanding Business Entities in India

Before diving into the specifics of each type of business entity, it's important to understand the general concept. A business entity is an organization established to conduct business. The type of entity determines the legal and tax responsibilities of the business owner(s).

Sole Proprietorship

Pros and Cons

Pros:

- Simple and inexpensive to establish.

- Complete control over business decisions.

- Profits taxed as personal income.

Cons:

- Unlimited personal liability for business debts.

- Harder to raise capital.

- Business continuity depends on the owner.

Who Should Choose This?

Sole proprietorship is ideal for small, low-risk businesses and individual entrepreneurs who want full control over their operations.

Partnership Firm

General Partnership

A general partnership involves two or more people who agree to share all business assets, profits, and liabilities.

Limited Liability Partnership (LLP)

An LLP is a partnership in which some or all partners have limited liabilities, protecting their personal assets.

Pros and Cons

Pros:

- Easy to establish.

- Shared financial commitment.

- Combined knowledge and skills.

Cons:

- Joint liability for business debts.

- Potential for conflicts between partners.

- Profit sharing.

Who Should Choose This?

Partnerships are suitable for businesses with multiple owners who want to share management responsibilities and profits. LLPs are ideal for professional services firms.

Private Limited Company

Benefits of a Private Limited Company

- Limited liability protection.

- Separate legal entity.

- Easier to raise capital through private equity.

Drawbacks of a Private Limited Company

- More complex and expensive to establish.

- Regulatory requirements and compliance.

- Restricted transfer of shares.

Who Should Choose This?

Private Limited Companies are ideal for businesses that plan to scale and attract investment, offering limited liability and a separate legal entity.

Public Limited Company

Benefits and Drawbacks

Benefits:

- Ability to raise capital by issuing shares to the public.

- Limited liability for shareholders.

- Increased credibility and transparency.

Drawbacks:

- Highly regulated and requires strict compliance.

- Extensive record-keeping and reporting.

- Greater public scrutiny.

Who Should Choose This?

Public Limited Companies are suitable for large businesses that need substantial capital and are willing to comply with stringent regulations.

One Person Company (OPC)

Benefits and Drawbacks

Benefits:

- Limited liability protection.

- Separate legal entity.

- Sole ownership with fewer compliance requirements.

Drawbacks:

- Limited to one shareholder.

- Cannot raise equity funding.

- Higher tax rates compared to other small business entities.

Who Should Choose This?

OPCs are ideal for solo entrepreneurs looking for limited liability and a separate legal entity without the complexities of a private limited company.

Comparing Business Entities

A comparison table can help you decide which entity is the best fit for your business.

| Feature | Sole Proprietorship | Partnership/LLP | Private Limited Company | Public Limited Company | OPC |

|---|---|---|---|---|---|

| Liability | Unlimited | Joint/Limited | Limited | Limited | Limited |

| Taxation | Personal | Pass-through | Corporate | Corporate | Corporate |

| Management | Owner | Partners | Directors/Shareholders | Directors/Shareholders | Sole Owner |

| Ease of Formation | Easy | Moderate | Complex | Very Complex | Moderate |

| Fundraising | Limited | Moderate | Strong | Very Strong | Limited |

Factors to Consider When Choosing a Business Entity in India

- Liability: Consider how much personal liability you are willing to assume.

- Taxes: Understand the tax implications of each business structure.

- Formation and Maintenance Costs: Consider the costs associated with forming and maintaining the entity.

- Flexibility: Evaluate the flexibility of the entity in terms of management and ownership changes.

- Capital Needs: Determine how easily you can raise capital under each structure.

Tax Implications in India

Taxation varies widely among business entities. Sole proprietorships and partnerships face pass-through taxation, while companies are subject to corporate tax rates.

Liability Considerations in India

Liability protection is a critical factor. Sole proprietorships and general partnerships offer no liability protection, while LLPs, private limited companies, and OPCs provide varying degrees of personal liability protection.

Ease of Formation and Management

Sole proprietorships and partnerships are easier to form and manage, while companies require more documentation and formalities.

Flexibility and Scalability

Corporations offer the most scalability, making them ideal for businesses that plan to expand significantly. LLPs and private limited companies provide flexibility in management and profit distribution.

Raising Capital

Public limited companies have an edge in raising capital due to their ability to issue stock to the public. Private limited companies and LLPs can also attract investors but with more limitations.

Conclusion

Choosing the right business entity in India requires careful consideration of your business goals, liability concerns, and tax implications. Consult with a legal or financial advisor to make an informed decision.