Tax season can be a daunting time for individuals and businesses alike, with complex forms,ever-changing regulations, and the looming fear of making mistakes. However, with the right guidance and resources, filing your income tax can be manageable and stress-free. In this blog, Startup Station, your one-stop solution for all things startup-related, will walk you through the steps to successfully file your income tax. As a company dedicated to simplifying the complexities of entrepreneurship, we understand the challenges you face and are here to help you navigate the tax maze confidently.

8 Easy Steps To Guide You Through Income Tax Filing

Step 1: Gather Your Documents

- Collect all necessary documents like Form 16, bank statements, and investment

proofs. - Having these at hand will make the filing process smoother and more accurate.

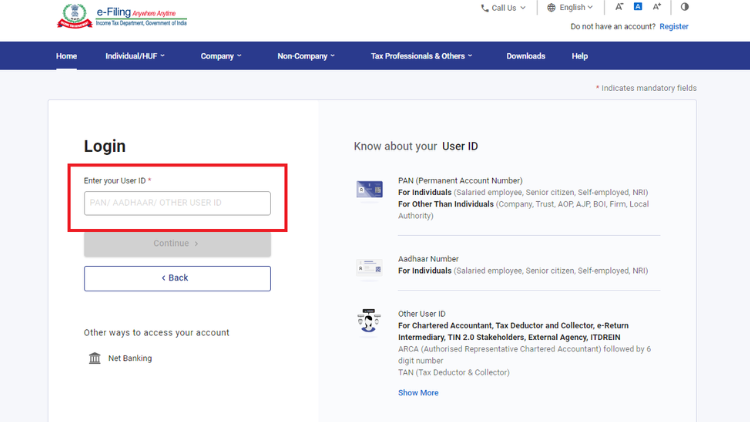

Step 2: Visit the Income Tax Portal

- Visit the official site of Income Tax e-filing.

- Click on 'Login' and enter your PAN as the User ID, then your password.

- Always ensure you're on the secure, official site to protect your data.

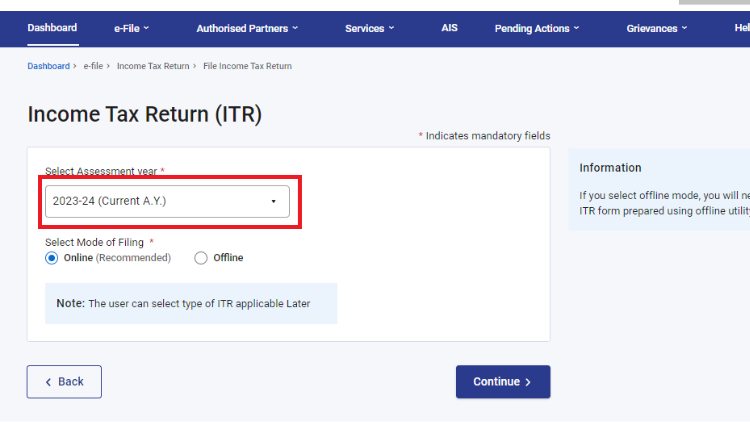

Step 3: Choose the Right Assessment Year

- Under 'e-File', select 'Income Tax Returns', then 'File Income Tax Return'.

- Choose the correct Assessment Year (AY) based on the Financial Year (FY) you'refiling for.

- For example, choose AY 2024-25 if you're filing for FY 2023-24.

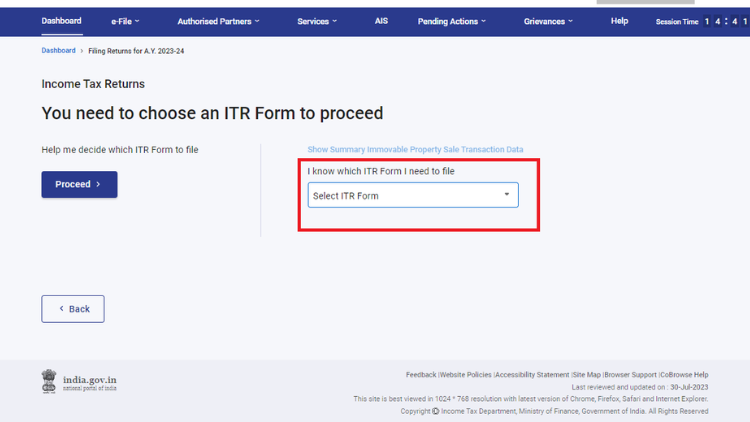

Step 4: Select Your Filing Status and ITR Type

- Choose your filing status: Individual, HUF (Hindu Undivided Family), or Others.

- Pick the right ITR form based on your income sources. For example, use ITR-1 for salary income or ITR-2 if you have capital gains.

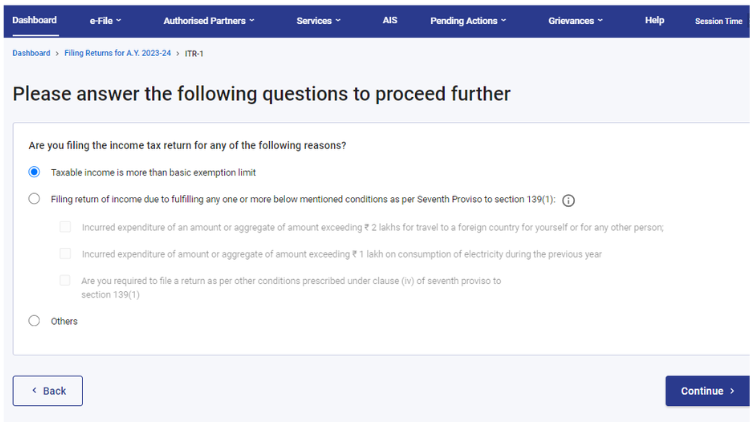

Step 5: Provide Your Filing Reason

- Indicate why you're filing, such as taxable income exceeding the basic exemption limit.

- This helps the tax department understand your filing context.

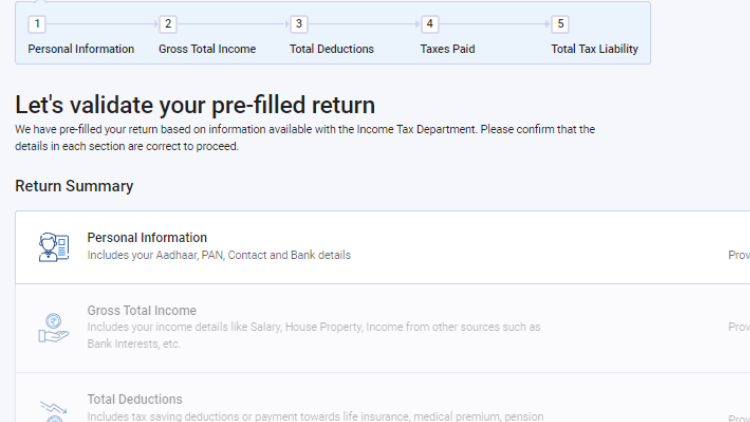

Step 6: Verify Pre-filled Information

- Most details like PAN, Aadhaar, and bank info will be pre-filled.

- Review this carefully to ensure accuracy. Wrong information can cause issues later.

Step 7: Fill in Income, Deductions, and Taxes

- Enter your income details from various sources like salary, rent, or investments.

- Claim eligible deductions under sections like 80C, and 80D to reduce your taxable income.

- The portal will calculate your tax liability. Pay any balance tax due.

Step 8: E-Verify Your Return

- After submitting, e-verify your return within 30 days. This is crucial; unverified returns are considered not filed.

- Use methods like Aadhaar OTP, net banking, or sending a physical ITR-V to CPC.

Avoid The Hassle, Choose Startup Station For Easy Income Tax Filing

By choosing Startup Station, you transform a daunting task into a simple, professional service, allowing you to concentrate on what you do best - growing your startup.

- Expert Guidance: Our seasoned tax professionals understand the nuances of income tax laws, ensuring your filing is accurate and maximizes your benefits.

- Time-Saving: Skip the learning curve and endless form-filling. Simply upload your Form-16, and we'll handle the rest, freeing you to focus on your core business.

- Quick Turnaround: We value your time. Our efficient team processes your filing and provides an acknowledgment within just 1-2 business days.

- Error Minimization: Manual filing can lead to costly mistakes. Our experts meticulously review your documents, reducing the risk of errors and potential penalties.

- Peace of Mind: With Startup Station managing your tax filing, you can rest easy knowing your compliance is in capable hands, reducing stress during tax season.

- Personalized Service: We don't just file; we understand your unique financial situation, offering tailored advice to optimize your tax strategy.

- Ongoing Support: Our relationship doesn't end with filing. We're here year-round toanswer questions and help plan for future tax implications.

Conclusion:

Filing your income tax doesn't have to be a headache. With our step-by-step guide, you've seen that it's a process you can manage. But why go it alone when you have a trusted partner in Startup Station? We take the complexity out of tax compliance, turning a daunting task into a simple, stress-free experience. Our expert team not only ensures accurate filings but also provides personalized advice to optimize your tax strategy. By choosing StartupStation, you're not just filing taxes; you're gaining peace of mind and freeing up valuable timeto focus on what matters most - growing your business.