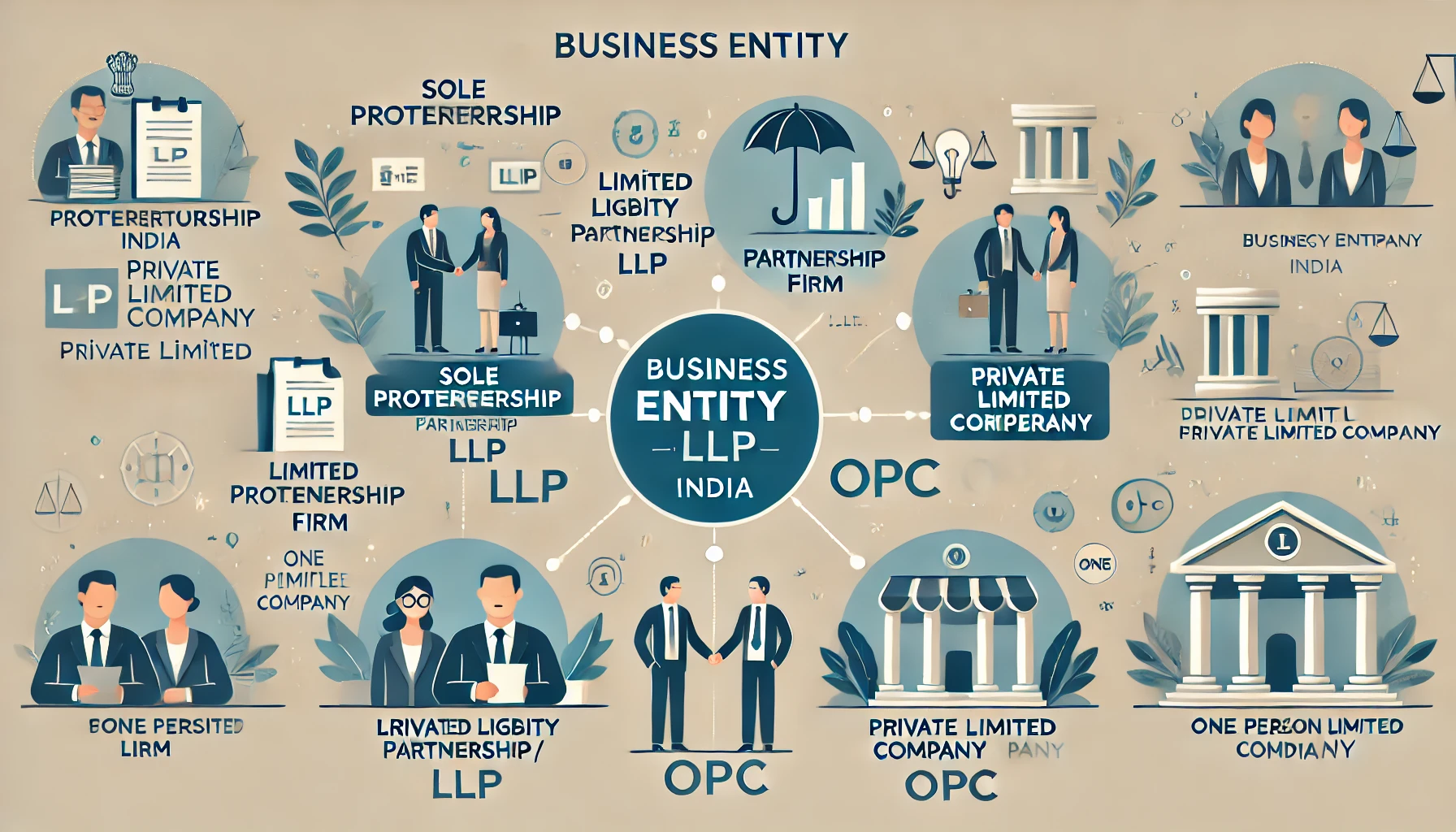

Proprietorship, partnership, and private limited company are three different forms of business structures, each with its own characteristics, advantages, and disadvantages. Here’s a brief overview of the differences between them:

Proprietorship:

Ownership: Sole proprietorship is a business structure owned and operated by a single individual.

Liability: The owner has unlimited personal liability for the business debts and obligations. Personal assets may be at risk.

Decision Making: The owner has complete control and makes all decisions.

Taxation: Profits are typically taxed as personal income of the owner.

Formation: Relatively easy and inexpensive to set up.

Partnership:

Ownership: Partnership involves two or more individuals (partners) who share ownership and responsibility for the business.

Liability: In a general partnership, partners have unlimited personal liability for the business debts. In a limited partnership, there may be limited partners with liability restricted to their investment.

Decision Making: Partners share decision-making authority, and responsibilities can be divided based on agreement.

Taxation: Profits and losses “pass through” to the partners and are reported on their individual tax returns.

Formation: Partnerships are relatively easy to form, but a partnership agreement is crucial to define roles, responsibilities, and profit-sharing.

Private Limited Company:

Ownership: A private limited company is a separate legal entity owned by shareholders. There can be multiple shareholders (owners).

Liability: Shareholders have limited liability, meaning their personal assets are generally protected from business debts.

Decision Making: Board of Directors manages the company, and shareholders’ influence is usually proportional to their ownership.

Taxation: The company is taxed on its profits, and shareholders are taxed on the dividends they receive.

Formation: Requires more formalities, including registration, compliance with regulations, and the issuance of shares. However, it offers a more structured and scalable business model.

In summary, the choice between proprietorship, partnership, and private limited company depends on factors such as the nature and scale of the business, the level of personal liability the owners are willing to assume, the desire for control and decision-making flexibility, and the long-term goals of the business. Each structure has its advantages and drawbacks, and entrepreneurs should carefully consider their specific needs and consult with legal and financial professionals before making a decision.